Get Ahead of the Curve: Preparing for the Major Tax Changes of 2026

Table of Contents

- Tax 2026 text on wooded blocks with blurred nature background. Taxation ...

- Major Changes to the 2026 Tax Brackets: Are You Prepared? | JC Castle ...

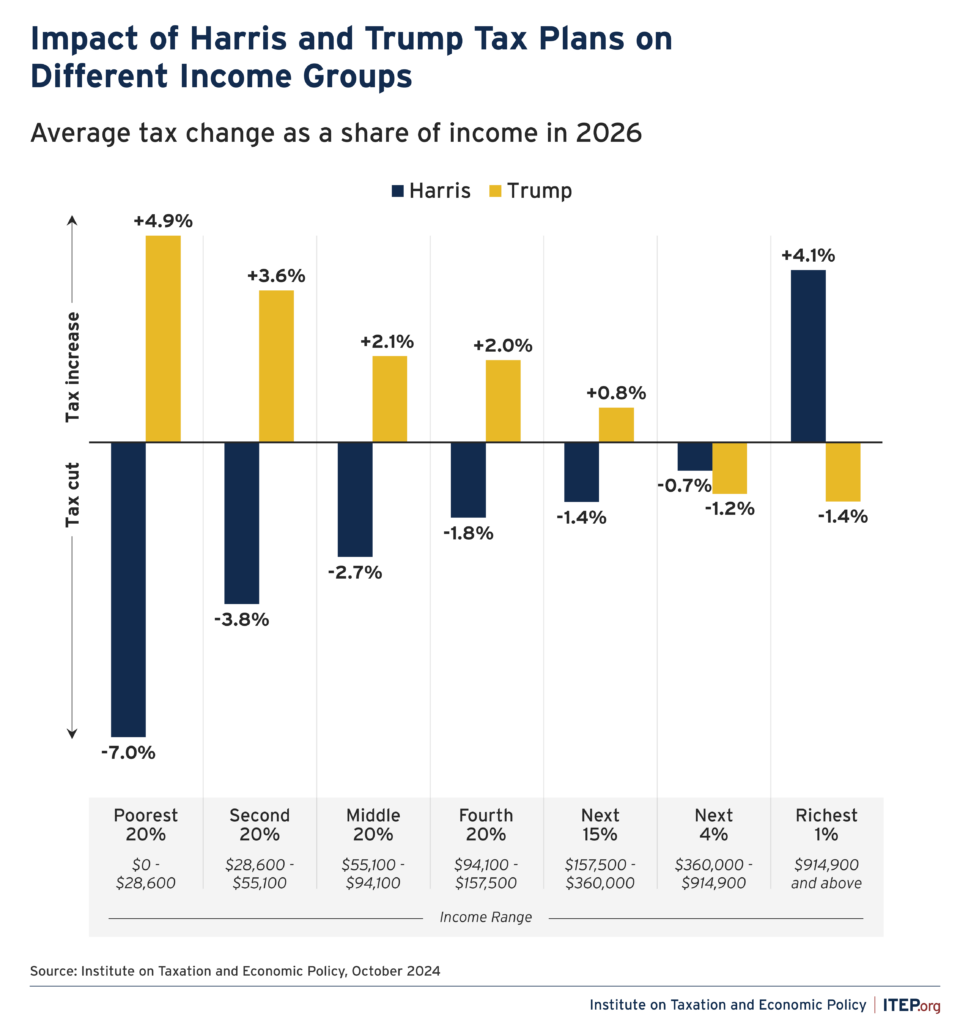

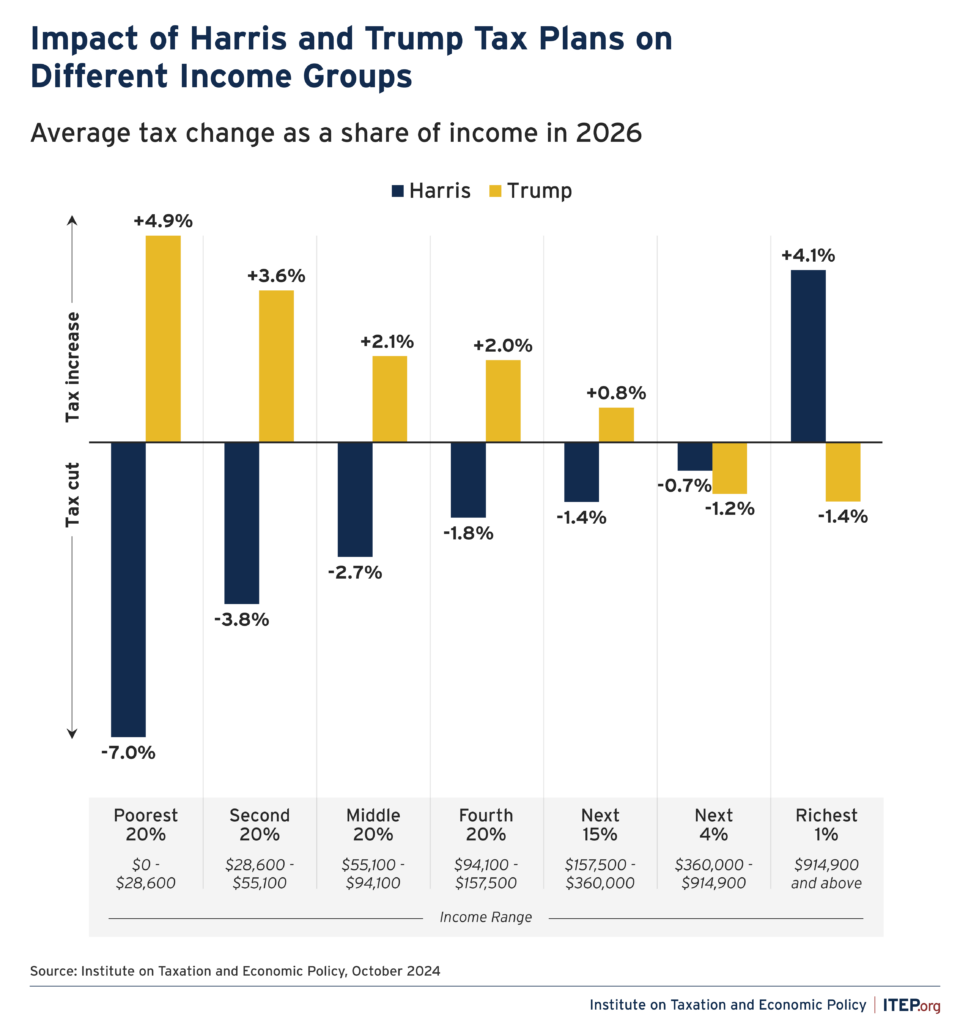

- How Would the Harris and Trump Tax Plans Affect Different Income Groups ...

- Tax Brackets For 2025: A Comprehensive Overview - List of Disney ...

- How Would the Harris and Trump Tax Plans Affect Different Income Groups ...

- Estimated Federal Tax Brackets 2026 - Printable 2025 Monthly Calendars

- Will Tax Rates Sunset In 2026? How to Plan Ahead - YouTube

- Plan now? The estate planning 2026 question mark | MassMutual

- First Glimpse at Tax Brackets in 2026 (And How Much More You’ll Have to ...

- T22-0091 - Share of Federal Taxes - All Tax Units, By Expanded Cash ...

What's Changing in 2026?

How Will These Changes Affect You?

Preparing for the Changes

While the full extent of the tax changes is still unclear, there are steps you can take to prepare: Consult a Tax Professional: A tax expert can help you understand how the changes will affect your specific situation and provide guidance on how to minimize your tax liability. Review Your Financial Plan: Take a close look at your budget, investments, and retirement savings to ensure you're on track to meet your financial goals. Consider Tax-Loss Harvesting: If you have investments that have declined in value, you may be able to offset gains from other investments by selling the losing investments and using the losses to reduce your tax bill. The major tax changes coming in 2026 are likely to have significant implications for taxpayers. By understanding the changes and taking proactive steps to prepare, you can minimize your tax liability and ensure you're well-positioned for the future. Stay informed, consult with a tax professional, and review your financial plan to get ahead of the curve and make the most of the new tax landscape.For more information on the tax changes and how to prepare, visit Forbes and consult with a qualified tax expert.